Review the background of Brex Treasury or its investment professionals on FINRA's BrokerCheck website. Consider your company’s investment objectives and relevant risks, charges, and expenses before investing. Please visit the Deposit Sweep Program Disclosure Statement for important legal disclosures.īrex Treasury is not an investment adviser. Brex Treasury is not a bank, and your Brex Cash account is not a bank account. Investing in securities products involves risk. Please contact our sales team for more information.īrex Treasury LLC is an affiliated SEC-registered broker-dealer and member of FINRA and SIPC that provides Brex Cash, an account that allows customers to sweep uninvested cash balances into certain money market mutual funds or FDIC-insured bank accounts at Brex’s partner banks, such as JPMorgan Chase Bank, Member FDIC and LendingClub Bank, N.A., Member FDIC. Use of Brex Empower is subject to the Platform Agreement. Use of the Brex API is subject to the Brex Access Agreement. See the Brex Platform Agreement for details. provides the Brex Mastercard® Corporate Credit Card, which is issued by Emigrant Bank, Member FDIC or Fifth Third Bank, NA., Member FDIC. Terms and conditions apply and are subject to change.īrex Inc. “Brex” and the Brex logo are registered trademarks.īrex products may not be available to all customers. Read our ebook, “ 6 Things to Keep in Mind While Implementing e-Invoicing” for everything you need to know when putting together an e-invoicing implementation plan.©2021 Brex Inc. If you’re looking to implement e-invoicing into your business, there are several key elements that you will need to keep in mind to ensure a smooth transition.

ONLINE INVOICING HOW TO

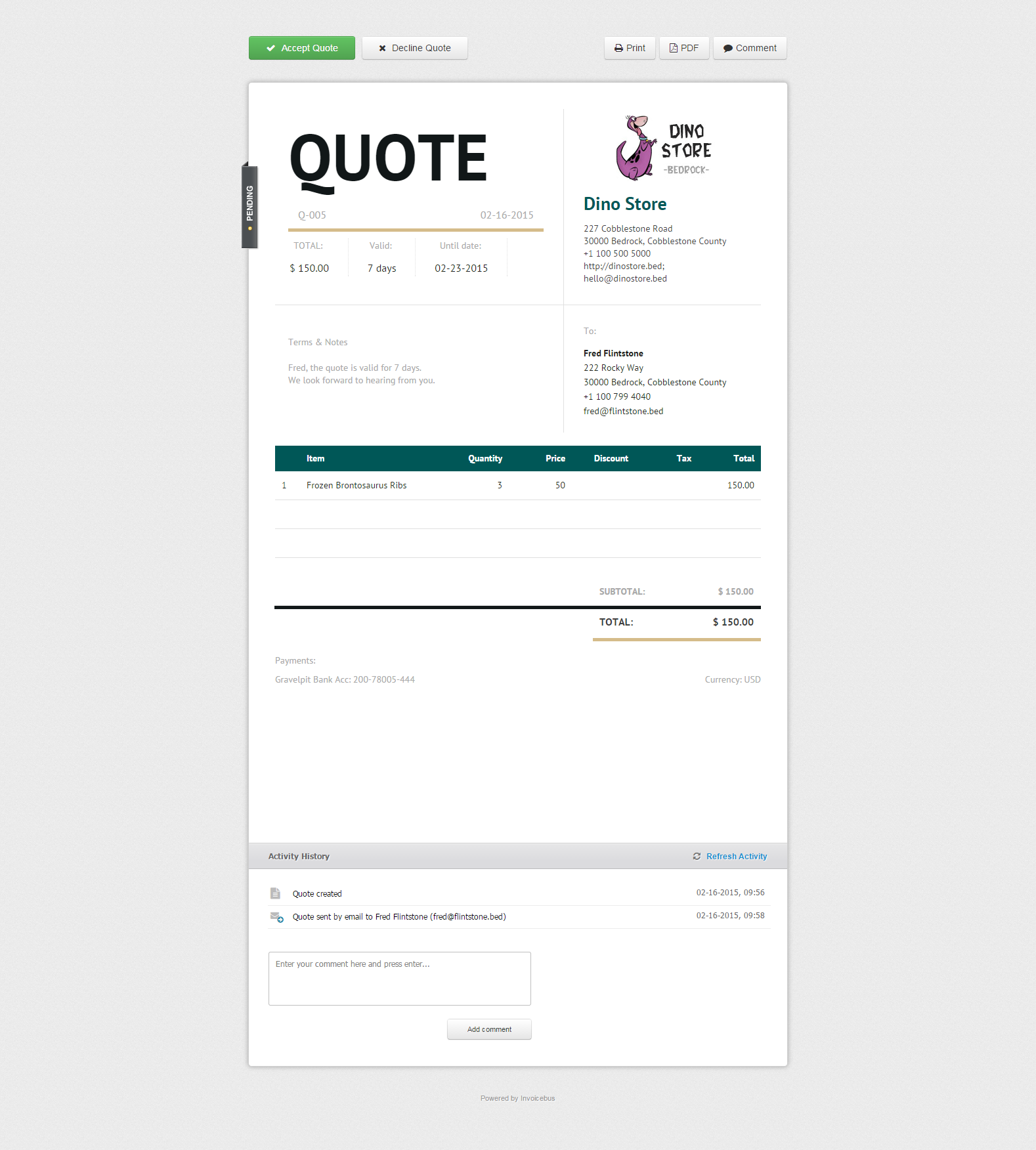

How to implement e-invoicing into your business? There are many e-invoicing solution providers out there, so when choosing the best option for you, it’s important that you do your research to determine whether or not they can meet the invoicing demands of your business. How to choose an e-invoicing solution provider?

Can it integrate with your existing ERP and/or other financial systems?.Will the system automatically receive invoices? What about sending invoices?.

ONLINE INVOICING SOFTWARE

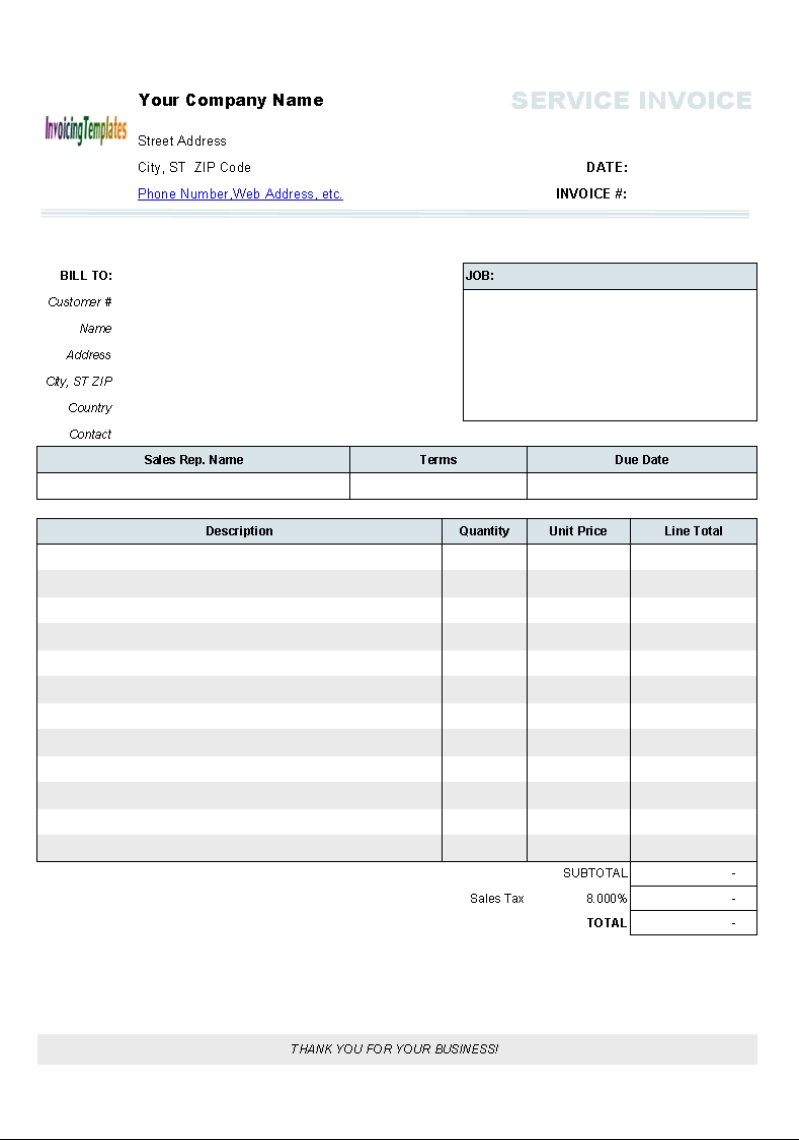

However, humans are much better at other things, such as forecasting, analysing cash flow, handling the complex invoice exceptions, etc. Processing invoices manually introduces the human factor, which unfortunately introduces greater risk of error than AP automation software.

ONLINE INVOICING MANUAL

And finally, manual invoicing involves a higher risk of errors. Tracking traditional invoices can also present a number of different issues, as paper invoices are not only easy to lose but they are also difficult to monitor. print or even an electronic PDF), requiring manual data entry – tying up valuable AP time and resources.īusinesses that use this type of system spend a significant amount of time manually handling and entering data, which can quickly become overwhelming if hundreds of invoices are received each day. With traditional invoices, whoever receives the data receives it in an unstructured format (ex.

One of the main challenges associated with traditional invoicing is that they are incredibly time-consuming to create and process, with processing often taking as long as 20+ days to complete. What are the challenges with traditional invoicing? This does, however, depend on the terms agreed between the buyer and supplier.Īn invoice is issued, transmitted, received, processed and stored electronically using structured document formats, meaning everything is completed online and streamlined to enhance the entire process. The vast majority of invoices are created with a net 30, meaning customers have 30 days to make the payment. When the product delivers or the service has been provided, the e-invoice can then be raised and sent digitally. This clarity is essential and allows the transaction to move forward.

The purchase order is critical to the invoicing process as it outlines the terms of the purchase, including the cost, delivery and payment method agreed for the transaction. Invoicing starts only after a purchase order has been received, and depending on the terms of the delivery of the good(s) or service(s), the invoice may be sent at a later stage. Invoicing is a segment of the entire procure-to-pay (P2P) cycle. The structured format allows an accounts payable (AP) receiving system to immediately understand each unique invoice field, to quickly begin the invoice processing cycle. E-invoicing, also known as electronic invoicing, is the exchange of invoice data between a supplier and a buyer in a “structured” format.

0 kommentar(er)

0 kommentar(er)